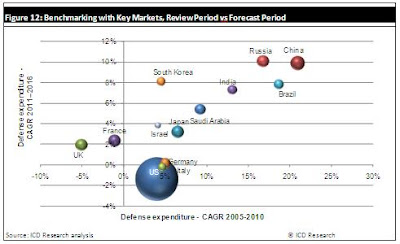

London, March 30th, 2012 – China’s defense budget is one of the largest in the world, second only to the US. In addition, China has a rapidly expanding presence in the international arms export market. The Chinese defense budget is expected to grow at a CAGR of 9.90% until 2016. While the Chinese defense budget will grow at a faster rate than the US defense budget growth during this time, the budget will still be considerably smaller than the US defense budget in 2016 (reference see figure 12 below).

China has the largest defense budget in Asia, and has the second-largest defense budget in the world. The country’s budget grew at a compound annual growth rate (CAGR) of 20.86% during the review period (2005–2010), which was fueled by the nation’s desire to become a global superpower, containing a strong economy and superior military force which can rival that of the United States. China’s defense industry has also benefited from the country’s strong economic growth, which has enabled large sums to be allocated for its defense industry.

Although the US currently dominates the world’s political, military and cultural outlook, China aims to emerge as one of the world’s largest economic powers and threaten the US’s military and economic supremacy. As such, the country has focused on modernizing its defense capabilities through the acquisition of advanced foreign weapons, significant investments in its domestic industrial technology, and upgrading its strategic nuclear force. As such, China’s defense expenditure grew at a CAGR of 20.86% during the review period, and is expected to grow at a CAGR of 9.90% during the forecast period.

China has instigated a military modernization program, which focuses on developing its navy, air defense systems, missile defense systems, C4I (Command, Control, Communications, Computers and Intelligence) capabilities and surveillance equipment. This program will continue throughout the forecast period with China raising its defense capital expenditure allocation from 34% of the total defense budget in 2010 to 39% in 2016.

Rising internal threats, alongside increased criminal activity, pose a security risk to Chinese homeland security. To address these risks, China is expected to spend a similar amount on homeland security as it does for external defense in 2011. The spending on homeland security aims to reduce criminal activity, riots, illegal immigration, illicit drug trading and human trafficking in the country. As Chinese homeland security is threatened by the protests and criminal activity of separatist groups from Tibet, Taiwan and Xinjiang, a substantial portion of the nation’s military budget is spent on policing these areas.

China does not have access to advanced military technology developed in Western countries due to the arms embargo placed on the country by the US and European countries following the 1989 Tiananmen Square massacre. Despite this several foreign companies have participated in the joint development, assembly and co-production of a variety of civilian products with Chinese companies, which have the potential to be used by the defense industry. As such, China has integrated its civil and military industries, which enables civilian technology to be utilized for defense products and vice versa.

To purchase the full version of ‘The Chinese Defense Industry Market Opportunities and Entry Strategies, Analyses and Forecasts to 2016’, please click here.

About Industry Review:

Industry Review is a collection of incisive, regularly updated market reports across 40+ industry sectors and 100+ countries.

We provide access to the latest data on global and local markets, key industries, top companies, M&A activity, new product launches and trends so you can make faster and better informed business decisions.

The reports in our store draw on robust primary and secondary research, proprietary databases, industry surveys and insightful analysis from our own expert teams and from carefully selected third-party publishers.

With access to over 400 in-house analysts and journalists, and a global media presence in over 30 industries, Industry Review delivers in-depth knowledge of local markets worldwide.

For more information, please visit our website at www.industryreview.com

For more information on the article, please contact:

Press Contact:

Shelly Wills

Tel: +44 (0) 20 7936 6671

shelly.wills@industryreview.com